Bringing More Care to More Kids

PHS was founded on the belief that kids deserve to be kids and grow up at home – even if they have medical complexities. And since opening our doors more than 30 years ago with seven employees, this simple mission has helped thousands of kids live their best lives in their homes and communities.

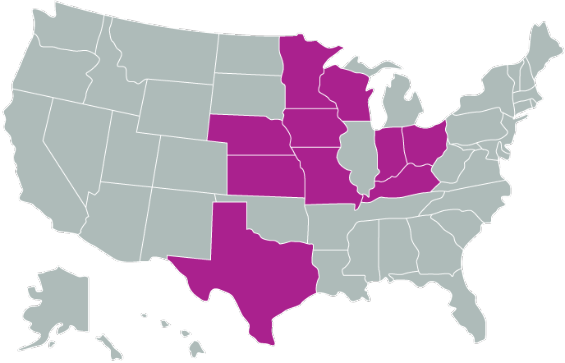

Today, our team spans 10 states with more than 20 offices, but our mission and our values remain the same. And we’re always looking for like-minded individuals ready to make a difference and bring more care to more kids.

PHS offers a competitive benefit package including paid time off, 401k match, medical, dental, vision, and more.

FAQs about PHS Careers

- Why should I be interested in working at PHS?

What we hear most is PHS has a very compelling mission. We take care of precious kids with incredible medical needs, helping them live at home. With more than 30 years of expertise in pediatric care, we have an outstanding reputation in the health care community. We have been recognized for our clinical excellence, outstanding health care outcomes, unwavering customer service, and high ethical standards.

The other comment we often hear is PHS vibrates with energy, and everyone is friendly. We have fun at work, and you won’t find an employer more committed to its employees. Not surprisingly, our employees are very proud to work here!

- Is it okay if this is my first job?

Of course! We provide on-the-job training (even for nurses!) to prepare you for your career. We do everything we can to help you be successful.

- How much education do I need to work at PHS?

For a number of our entry-level or support positions we require only a high-school diploma or equivalent. There are some positions that require experience, certification, a license, or a degree. The job ad will specify what is required.

- What do I do if I am interested in applying for a job at PHS?

It’s easy! Simply click here to go to our Careers page, or navigate there by clicking on the link in the upper right corner to apply to the specific position/job title that interests you. Select the desired job, and click on the “Complete your Application” link. It’s helpful to have some information prepared such as your biographical data, work history, names and numbers of contacts, education background, etc. You will also want your resume and cover letter ready to attach as a document. Due to the high volume of applications we receive, we prefer you apply online rather than through the mail, email, or in person.

- How long does the application process take?

Completing the online application should take 20-30 minutes, but may vary depending on the position you apply for.

- What if I’m interested in PHS but don’t see any jobs I’m interested in right now?

Keep an eye on our website. We immediately post any job opportunities as they become available.

- If I sent you my resume, do I still need to complete an application?

Yes. Even though your resume contains most of what we need, we prefer you complete an online application because it is a formal document electronically signed by you authenticating the information you provide.

- How do I know if you received my application?

If you submitted your application online, you will receive an automated acknowledgment sent to the email address you provided on our online application. If you don’t see the acknowledgment email in your inbox, be sure to check your spam/junk folder.

- Shall I call PHS to check the status of my application?

Due to the volume of applicants, we cannot guarantee that we will contact every applicant personally. We will contact you directly if we are interested in arranging a phone or in-person interview.

- What types of background checks does PHS conduct as part of the hiring process?

After your offer, we conduct a thorough evaluation of your background including a social security trace, verification of federal, state, and county criminal records, motor vehicle records, citations of medical fraud and abuse, and any citations on medical licenses, as well as past employment and education verification. In rare instances, and only when required, we may conduct a credit check. All prospective employees must also submit to a drug and alcohol screening.

- How do I contact you if I have questions or technical difficulties?

Call 1-800-225-7477 during regular business hours (8 a.m.-5 p.m.) or email us.